Yearly salary calculator with overtime

Overtime pay. Calculate the approximate number of hours that.

Excel Formula Basic Overtime Calculation Formula

1000 15 1500 Overtime Pay per Period.

. 10 x 40 hours 400 base pay 10 x 15 15 overtime rate of pay 15 x 6 overtime hours 90. Overtime pay per period. 1000 Regular Pay per Period.

Calculate overtime pay for a monthly-rated employee. Biweekly Salary Annual Salary 26. How to use the Take-Home Calculator.

A non-workman earning up to 2600. Assuming you make a hundred thousand dollars in 12 months your hourly wage is 100000 2080 or 4807. B A OVWK.

20Regular payhour X 15 X 2 hours 60 Overtime Pay. Hourly pay Monthly salary 12 Hours worked per week Weeks per year. The Salary Calculator has been updated with the latest tax rates which take effect from April 2022.

2084 x 10 overtime hours 20840 total overtime wages Step 5. First of all we need to find his pay per day. Overtime pay per year.

You can now use your hourly pay to determine your overtime for a week of work as an. To decide your hourly salary divide your annual income with 2080. The adjusted annual salary can be calculated as.

To do this divide the monthly salary by 26 days. Then take the daily rate and divide that figure by the number of hours to get the employees hourly rate. To do this divide the monthly salary by 26 days.

Calculate your overtime pay. Using 10 holidays and 15 paid vacation days a year subtract these non-working days from the total. The algorithm behind this overtime calculator is based on these formulas.

Enter the number of paid weeks the employee works per year. Summary report for total hours. Try out the take-home calculator choose the 202223 tax year and see how it affects.

Multiply the overtime hourly rate by the number of extra hours the employee worked. You can claim overtime if you are. A RHPR OVTM.

The calculation of overtime for a salaried employee is different. How to use the overtime calculator Input the employees annual salary. For example if a contracted IT support specialist makes 20 per hour and works 40 hours a week for a year or.

This workers total pay due including the overtime premium can be calculated as follows. If you are a monthly-rated employee covered under Part IV of the Employment Act use this calculator to find out your pay for. The final figure will be your hourly wage.

The remaining amount is referred to as an adjusted salary. Overtime work is all work in excess of the normal hours of work excluding breaks. 1500 50 hours 7500 Total Pay.

30 8 260 - 25 56400. Yearly salary Hours of work per year Hourly rate. This calculator can help with overtime rates that are 15 and 2 times the rate of the employees base pay.

57 rows The Annual Salary Calculator will translate your hourly pay into its yearly monthly biweekly weekly and daily equivalents including any weekly time-and-a-half overtime. RM1800 RM26 RM6923. Lets say you earn 2500 per month and work 40 hours.

Multiply that variety by fifty two the variety of weeks in 12 months. 1000 400 hours 40000 Overtime Pay Rate.

What Is Annual Income How To Calculate Your Salary Income Income Tax Return Salary Calculator

4 Ways To Calculate Annual Salary Wikihow

Overtime Pay Calculators

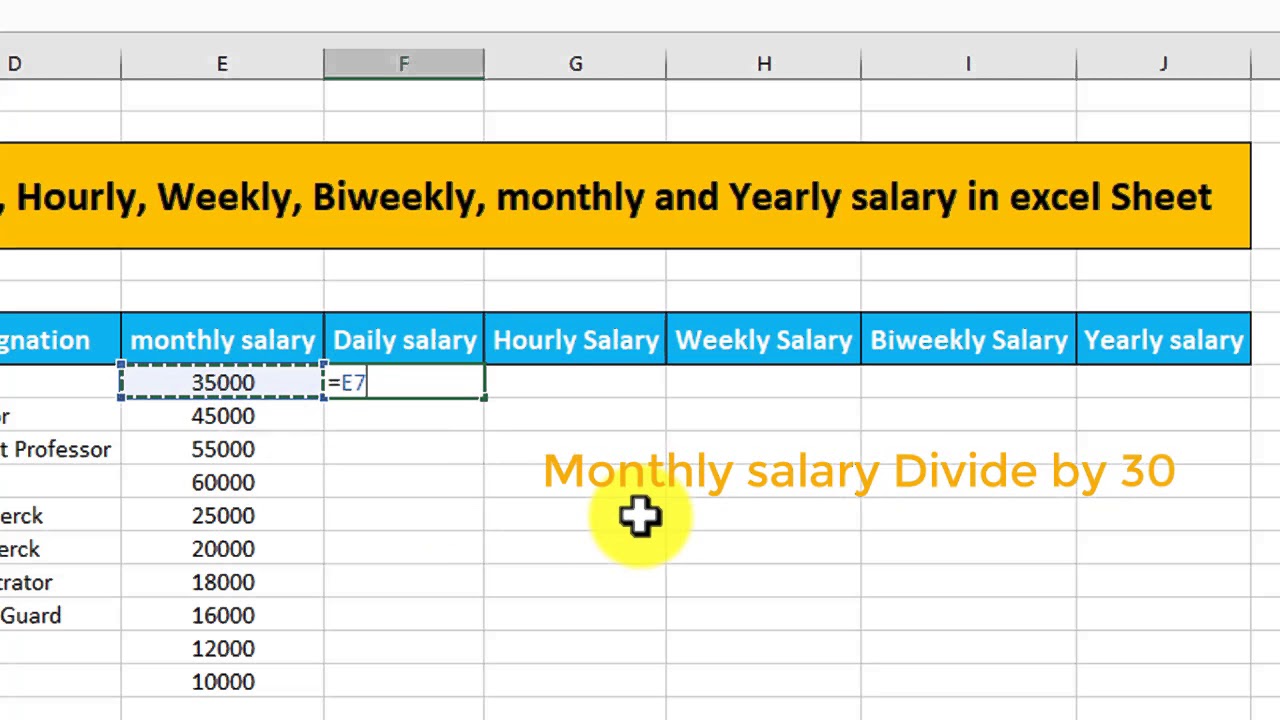

How To Calculate Daily Hourly Weekly Biweekly And Yearly Salary In Excel Sheet Youtube

How To Calculate Overtime Pay From For Salary Employees Youtube

Overtime Calculator To Calculate Time And A Half Rate And More

Overtime Calculator

Hourly To Salary Calculator

How To Calculate Overtime Pay Easy Overtime Calculator A Basic Guide

Overtime Calculator Workest

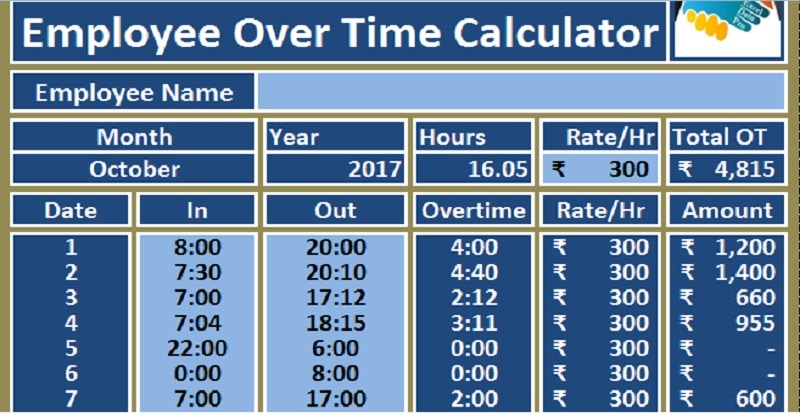

Download Employee Overtime Calculator Excel Template Exceldatapro

Hourly To Salary Calculator Convert Your Wages Indeed Com

Annual Income Calculator Calculator Academy

How To Calculate Wages 14 Steps With Pictures Wikihow

How To Calculate Wages 14 Steps With Pictures Wikihow

How To Calculate Gross Weekly Yearly And Monthly Salary Earnings Or Pay From Hourly Pay Rate Youtube

Hourly To Salary What Is My Annual Income